Breaking Down the September 2025 NDSU Agricultural Trade Monitor: Zero Soybean Sales, Record Basis Weakness

- CAPTS NDSU

- 1 day ago

- 2 min read

Updated: 17 hours ago

The September 2025 edition of the NDSU Agricultural Trade Monitor, published by North Dakota State University’s Center for Agricultural Policy and Trade Studies (CAPTS), documents a historic break in U.S.–China agricultural trade relations. For the first time in recent history, no new-crop soybean sales to China have been recorded heading into the 2025/26 marketing year. This unprecedented development is reshaping marketing flows, pressuring cash prices, and forcing transportation networks to pivot toward alternative markets.

As shown in Exhibit 1, total new-crop soybean commitments to China are flat at zero, a striking contrast to the sharp late-summer buying curves of previous years. Exhibit 2 highlights that total outstanding U.S. soybean contracts stand at only 8.05 MMT, roughly half of 2023 levels and one-third of 2022 volumes. The shortfall has not been offset by increased purchases from Mexico, Canada, or “unknown” destinations, leaving a historically large portion of supply uncommitted as harvest begins.

Exhibit 1: Total Soybean Commitments (Accumulated Exports + Outstanding Sales) to China in Million Metric Tons (MMT) | Exhibit 2: U.S. Export Sales of New-Crop Soybean as of End of August 2025 |

|  |

Basis Collapse Across the Upper Midwest

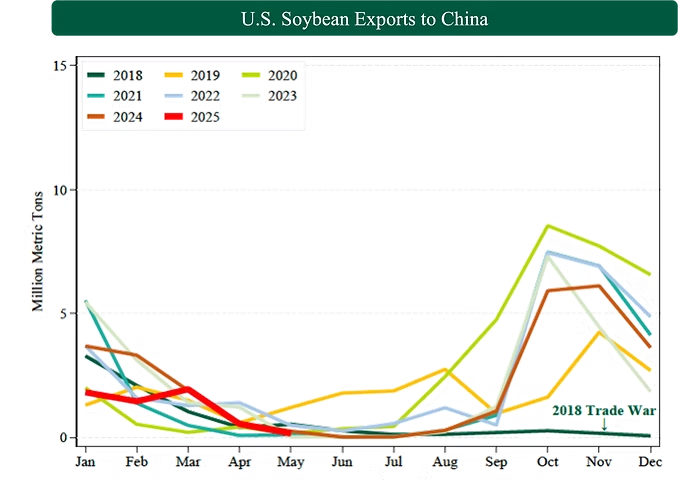

The impact on local markets is immediate. Exhibit 3 shows North Dakota’s soybean forward basis plunging to record lows near −150 ¢/bu, even deeper than during the 2018 trade war and occurring weeks earlier in the season. Minnesota and South Dakota basis levels follow similar trajectories, near −100 ¢/bu, reflecting their reliance on PNW rail routes.

Exhibit 3: Soybean Exports to China in 2018-2025

A county-level map in Exhibit 4 highlights that the weakest basis values are concentrated in central and western North Dakota, eastern Montana, and parts of South Dakota. In contrast, counties along the Mississippi River corridor maintain relatively narrow basis levels due to Gulf export access.

Exhibit 4: Average Soybean Forward Basis in September 2025

Soybean Cash Prices Well Below Breakeven

According to Exhibit 5, cash soybean prices across much of the Northern Plains have fallen below $8.50/bu; more than $3.00 under breakeven levels for many producers. This creates severe negative margins just as farmers rely on harvest sales to cover expenses. Even with expanded domestic crushing capacity, the additional demand has been insufficient to counter the loss of China’s purchases.

Exhibit 5: Average Soybean Spot Price during the First Week of September 2025.

Wider Commodity and Export Impacts

The weakness extends beyond soybeans. Exhibit 6 shows near-zero outstanding sales to China for corn, wheat, and sorghum, collectively the four largest U.S. export commodities by volume. USDA projects U.S. agricultural exports to China at only $9 billion for 2025/26, below even 2018/19 trade war levels and 75% lower than the $36 billion peak in 2021/22.

Exhibit 6: Outstanding Sales to China in MMT (Cotton in Bales) at the End of August 2025

Read the full September 2025 NDSU Agricultural Trade Monitor and access data tables: https://doi.org/10.22004/ag.econ.369070

📩 For inquiries, contact:

Shawn Arita – shawn.arita@ndsu.edu

Jiyeon Kim – jiyeon.kim@ndsu.edu

Wuit Yi Lwin – wuityi.lwin@ndsu.edu

Sandro Steinbach – sandro.steinbach@ndsu.edu

Xiting Zhuang – xiting.zhuang@ndsu.edu