Breaking Down the December 2025 NDSU Agricultural Trade Monitor: Supreme Court, Food and Input Tariff Relief, and Market Access Opportunities Through Recent Deals

- CAPTS NDSU

- Dec 8, 2025

- 5 min read

The December 2025 edition of the NDSU Agricultural Trade Monitor focuses on three major forces reshaping U.S. agricultural trade heading into 2026: the pending Supreme Court ruling on IEEPA tariffs, November tariff exemptions on food and agricultural inputs, and a new wave of reciprocal trade agreements that expand export opportunities. Together, these developments affect input costs, market access, and the balance between policy-driven commitments and market fundamentals.

Supreme Court to Rule on IEEPA Tariffs

In 2025, the administration relied on three main authorities to impose tariffs: the International Emergency Economic Powers Act (IEEPA), Section 232 of the Trade Expansion Act, and Section 301 of the Trade Act. Under IEEPA, “fentanyl” tariffs on Canada, Mexico, and China were layered on top of broad “reciprocal” tariffs aimed at partners with large bilateral deficits.

Importers and several states challenged the IEEPA tariffs, arguing that the statute does not clearly authorize tariffs and that delegating such power raises constitutional concerns. Lower courts agreed but allowed the measures to remain in place while the Supreme Court reviews the case. On November 5, 2025, the Court heard oral arguments in Learning Resources v. Trump and Trump v. V.O.S. Selections, focusing solely on IEEPA.

Possible outcomes range from striking down all IEEPA tariffs to allowing only fentanyl tariffs, to fully upholding current policy, or dismissing the case on procedural grounds. Prediction markets currently assign only about 25–28% probability that the tariffs will be upheld in full, suggesting that some constraint on IEEPA authority is seen as more likely than a complete endorsement.

Beyond legality, the ruling will shape whether previously collected tariffs might be refunded and how freely future administrations can use IEEPA as a trade tool. For agriculture, the key channel is indirect: changes in U.S. tariff policy could influence whether trading partners maintain or lower their own tariffs on U.S. farm products.

November Exemptions Ease Tariffs on Agricultural Inputs

While the legal case proceeds, tariff policy has already shifted. In mid-November, new Executive Orders excluded a large set of agricultural input products from reciprocal tariffs. Key fertilizers, UAN, urea, ammonium sulfate, DAP, and MAP, are now exempt, along with several machinery parts. These products account for nearly half of U.S. fertilizer imports, and when combined with April exemptions, about 84% of fertilizer imports are now outside the scope of IEEPA tariffs.

The changes reduce the trade-weighted effective IEEPA tariff on agricultural inputs from 11% to 9%, with the sharpest reductions in fertilizer and pesticide categories. Mixed/organic fertilizer, nitrogen, and phosphate record drops of more than five percentage points, while agricultural machinery sees smaller changes because tractors and many machine categories remain under higher tariffs or sanctions.

Exhibit 1: Top Countries Supplying U.S. Agricultural Inputs and IEEPA Tariff Rates (As of November 20, 2025).

Map of top input suppliers, key products, and statutory vs. effective IEEPA rates, showing the average effective tariff falling to 9%.

For U.S. producers, these cuts directly lower the cost of imported fertilizer and crop protection products, partially offsetting earlier cost increases and easing margin pressure heading into the 2026 planting season.

Food Import Tariffs Fall, Especially for Beef, Coffee, and Fresh Produce

A parallel set of November actions targets food imports. Cocoa products, coffee, most beef products, fresh fruits, tree nuts, and other items central to U.S. consumption and processing chains are now exempt from reciprocal tariffs. Country-specific reductions, such as China’s rate falling from 30% to 20% and Switzerland’s from 39% to no higher than 15%, further lower the overall burden.

Overall, the effective IEEPA tariff on U.S. imports of agricultural and food products declines by more than six percentage points compared with August, bringing the effective rate to around 13.5%, of which only about 8.9% is actually applied after exemptions. The largest reductions are concentrated in beef, coffee, and fresh fruits and vegetables.

Exhibit 2: Trade-Weighted Effective Tariff Rates by Agricultural and Food Products (As of November 20, 2025).

Chart of MFN, IEEPA, and effective rates across commodity groups, with the biggest declines in beef, coffee, and fresh produce.

These adjustments lower costs for importers, food manufacturers, and consumers and signal a move toward a more targeted, less broadly restrictive tariff policy than earlier in 2025.

Market Access Gains through Reciprocal Trade Deals

Tariff relief is complemented by a series of reciprocal trade negotiations across Latin America, Southeast Asia, East Asia, and Europe. Recent deals combine tariff reductions, reforms to non-tariff barriers (NTBs), and, in some cases, explicit purchase commitments for U.S. agricultural products.

Two agreements, those with Cambodia and Malaysia, have been completed. They eliminate tariffs on U.S. agricultural goods, streamline licensing and SPS certification, and commit to avoiding new agricultural barriers. Framework agreements with Thailand, Vietnam, Indonesia, the EU, Japan, the UK, Switzerland, Guatemala, El Salvador, Ecuador, and Argentina are moving forward with varying mixes of tariff cuts, NTB reforms, and purchasing targets.

Exhibit 3: Market Access Commitments through Recent Deals in 2025.

Global map summarizing 2024 U.S. agricultural exports to each partner, top exported products, and the core provisions of each agreement.

In several markets, average NTB cost equivalents exceed MFN tariff rates, so measures such as mutual recognition of SPS certificates, simpler registration, and streamlined customs can matter as much as tariff reductions. Some agreements also include sizable purchase commitments, supporting near-term demand while reinforcing longer-term export relationships, though their impact will ultimately depend on follow-through and implementation.

China’s Soybean Commitment: Strategic Buying vs. Market Fundamentals

The December analysis revisits China’s multi-year soybean purchase commitments, announced in the October U.S.–China deal. China pledged to import 12 million metric tons (MMT) of U.S. soybeans in 2025, followed by 25 MMT annually during 2026–2028, for a total of 87 MMT.

Historically, China’s soybean procurement has closely tracked relative landed prices, shifting toward U.S. supplies when the premium over Brazilian soybeans narrows to around $20/mt.

Exhibit 4: Brazil–U.S. Soybean Landed Price with Tariff in China Differential by Week and U.S. Daily Flash Sales to China in 2025.

Plot of weekly price differentials and daily flash sales, showing several November 2025 purchases even when U.S. soybeans were about $80/mt higher than Brazilian supplies, evidence of policy-driven buying.

Despite these strategic purchases, China remains far from the 2025 target.

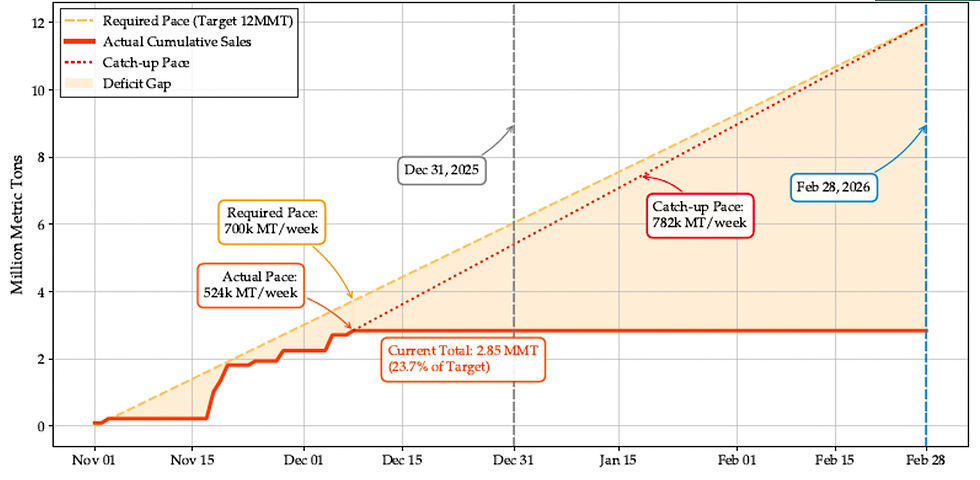

Exhibit 5: Comparison of Actual U.S. Soybean Sales to China vs. Required Pace (Target 12 MMT).

By early December, cumulative sales stood at 2.85 MMT, just 24% of the target, with actual purchases averaging about 524,000 MT per week versus a required pace of roughly 700,000 MT per week. Catching up would now require more than 782,000MT per week.

Current trends highlight how sharply purchases would need to accelerate and raise questions about how strictly volume-based commitments will be honored if market conditions remain unfavorable.

Looking Ahead

Heading into 2026, U.S. agriculture faces a landscape shaped by courts, executive actions, and negotiated agreements. The Supreme Court’s ruling on IEEPA will determine how flexible future administrations can be in using emergency trade tools. Recent tariff exemptions are lowering costs for fertilizers, pesticides, beef, coffee, and fresh produce. Reciprocal trade deals in Asia, Europe, and Latin America promise new opportunities if NTB reforms and purchase commitments are implemented as planned. And China’s soybean commitments illustrate the tension between policy-driven targets and market fundamentals.

Read the full December 2025 NDSU Agricultural Trade Monitor: https://ageconsearch.umn.edu/record/376295?v=pdf

For inquiries, contact:

Shawn Arita – shawn.arita@ndsu.edu

Matthew Gammans – matthew.gammans@ndsu.edu

Jiyeon Kim – jiyeon.kim@ndsu.edu

Wuit Yi Lwin – wuit.yi.lwin@ndsu.edu

Sandro Steinbach – sandro.steinbach@ndsu.edu

Ming Wang – ming.wang@ndsu.edu

Xiting Zhuang – xiting.zhuang@ndsu.edu